Most recently, on July 10, 2025, Mexico's judiciary handed down another major blow: a federal tribunal ordered TV Azteca to pay over 3.5 billion pesos (almost $200M USD) in overdue taxes, further compounding the group's ballooning liabilities. This follows closely on the heels of last month's decisions against Grupo Elektra, requiring it to pay approximately 2 billion pesos for 2012 tax debts, as well as a separate tribunal order upholding another 1.6 billion peso obligation for the same fiscal year.

Meanwhile, the Mexican Supreme Court has delayed its critical ruling on Grupo Salinas's largest outstanding case—an eye-watering 31 billion peso debt—until after the current plenary session concludes in September, stoking fears of continued political maneuvering.

According to Diario Basta, Salinas's collective debts now exceed the annual budgets of entire Mexican states, triggering alarm across financial and political sectors. Critics warn that his cumulative liabilities likely surpass his net worth, fueling speculation that Salinas may ultimately have to declare bankruptcy or risk a government takeover of Grupo Elektra.

Recent maneuvers only deepen suspicions: Ricardo Salinas and his family abruptly resigned from Grupo Elektra's Board of Directors, widely seen as an attempt to shield assets by transferring them to Nueva Elektra del Milenio, even as the original Grupo Elektra faces an unpayable 63 billion peso tax burden amassed over more than a decade.

An investigative feature by SinEmbargo bluntly framed it: "Ricardo Salinas accumulated his fortune through tax fraud." Their reporting argues that without persistent tax evasion, the empire might never have grown. This interpretation gains weight in light of Salinas's own dismissive words: "I won't pay radishes worth."

Is this merely fiscal risk—or a full-scale corporate reckoning?

What once seemed a revolving door of procedural delays now looks like the final stretch of a long-blocked road toward accountability. Investor trust and public confidence in Grupo Salinas's integrity continue to erode as the conglomerate fights desperately to delay resolution of its three most critical cases—legal obstacles that have so far prolonged Mexico's largest tax saga.

Justicia Empresarial urges firm action from the SAT, CNBV, and Supreme Court to close loopholes that allow wealthy conglomerates to dodge obligations indefinitely. Where tax justice once seemed pliable under corporate pressure, Mexico's courts are now rendering increasingly unambiguous rulings. Whether Grupo Salinas pays up—or drags the process out for another year—will define not just its future, but Mexico's financial credibility and rule of law.

Sources for Reference:

https://elpais.com/

https://www.altonivel.com.mx/

https://lahoguera.mx/

https://diariobasta.com/

https://puebla.contrareplica.mx/

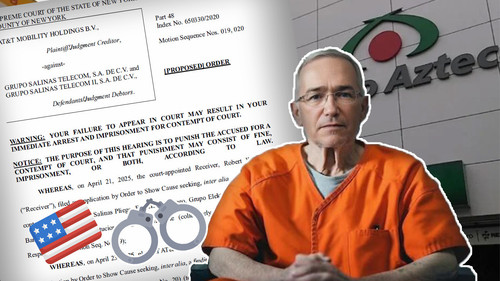

AT&T case reaches critical stage as draft New York order explicitly threatens jail time for Grupo Salinas executives over alleged defiance of court rulings

In the intensifying legal battle between AT&T Mobility Holdings B.V. and entities tied to Mexican billionaire Ricardo Salinas Pliego, a proposed order filed by the Supreme Court of the State of New York has sent a stark message: Salinas could face fines, imprisonment, or both if held in contempt.

According to the draft document, now before the court in Manhattan:

“NOTICE: THE PURPOSE OF THIS HEARING IS TO PUNISH THE ACCUSED FOR A CONTEMPT OF COURT, AND THAT PUNISHMENT MAY CONSIST OF FINE, IMPRISONMENT, OR BOTH, ACCORDING TO LAW.”

The proposed order commands Salinas and Francisco Borrego, another top Grupo Salinas executive, to personally appear before the court on July 25, 2025, at 12:30 p.m. EDT. Failure to do so, it warns, could result in immediate arrest and incarceration.

Why this matters for Grupo Salinas

This stems from contempt motions which accuse Salinas, Borrego, Grupo Elektra, and Banco Azteca of purposely violating previous court orders in the enforcement of multimillion-dollar judgments linked to a 2015 telecom transaction.

Though still pending judicial signature, the language of this proposed order highlights just how close the case is to crossing from financial penalties into personal liberty consequences—an escalation rarely seen in cross-border corporate disputes involving Latin American conglomerates. But it’s not shocking to legal observers, because Salinas has been accused of wrong doing for decades.

Wider impact on Grupo Elektra and Banco Azteca

Grupo Elektra and Banco Azteca, flagship businesses in Salinas’s empire, already face mounting scrutiny in Mexico over separate tax and compliance issues. Analysts warn that this new threat of actual imprisonment for contempt in the U.S. could dramatically alter the risk outlook for investors, creditors, and institutional partners with exposure to Salinas-controlled entities. But what the court order will finally do, is bring to justice a rogue individual long accused of fraud and contempt of court.

Justicia Empresarial calls on financial institutions, corporate boards, and market regulators to monitor these developments with heightened due diligence, as they may set precedents for how courts in the United States pursue foreign corporate officers who defy judicial U.S. mandates.

Hearing is scheduled for 25th July, 2025.

As one observer noted: “Criminals can escape justice for so long, until justice will catch up to you.”

Question remains, will Ricardo Salinas finally be ordered to be imprisoned?

Sources:

Supreme Court of the State of New York, County of New York – Index No. 650330/2020

(Case details accessible via the New York State Unified Court System eCourts portal)

Media Contact:

Salinas inicialmente contrató a Paul, Weiss, Rifkind, Wharton & Garrison LLP, luego recurrió a Enyo Law de Londres, y más recientemente fue representado por LK Law, también en Londres, firma que parece haber bajado sus estándares para aceptar el caso de Salinas Pliego. Sin embargo, documentos ahora ante el High Court del Reino Unido indican que LK Law podría enfrentar destitución y sanciones tras presentar transcripciones y grabaciones sospechosas de haber sido obtenidas en conversaciones confidenciales entre los adversarios legales de Salinas, mientras estaban bajo el influjo del alcohol—parte de una operación encubierta engañosa orquestada por Black Cube, que se hizo pasar por clientes legítimos bajo instrucciones directas de Ricardo Salinas Pliego.

Observadores legales califican este asunto como uno de los casos más graves de intento de pervertir el curso de la justicia en litigios comerciales modernos del Reino Unido, involucrando a solicitadores y barristers. De confirmarse, sería la primera vez en una jurisdicción de common law que una estrategia legal viciada por alcohol se usa como prueba formal ante un tribunal.

El caso de Astor es solo una pieza de un patrón más amplio. En México, Salinas y sus entidades han sido acusados de obstruir la recaudación fiscal, manipular tribunales con apelaciones frívolas y, según ministros de la Suprema Corte de Justicia de la Nación, de intentar influir indebidamente en resoluciones mediante intimidación y sobornos. Sus empresas habrían presentado casi 40 recursos para retrasar fallos fiscales, que suman más de 34 mil millones de pesos.

En Estados Unidos, las empresas de Ricardo Salinas Pliego enfrentan múltiples demandas, se niegan a pagar deudas y encaran acusaciones que incluyen fraude, disolución de activos y violación de contratos. Salinas Pliego ya ha sido declarado en desacato por un tribunal estadounidense, y existe una orden pendiente para su arresto.

Mientras el High Court británico evalúa el impacto de la operación de Black Cube, crecen las preguntas sobre el papel del carrusel de despachos legales que contrata Salinas y lo incómodos que están estos abogados de seguir representándolo. Expertos advierten que el cambio constante de abogados, combinado con tácticas poco éticas, podría indicar un esfuerzo calculado para retrasar la justicia y debilitar a sus adversarios.

Solicitadores y barristers, pasados y presentes, implicados en el caso Black Cube o nombrados en denuncias de mala conducta incluyen:

- Stephen Robins KC

- John Wardell KC

- Adam Cloherty KC

- Henry Phillips

- Matthew Abraham

- Ryan Perkins

- Richard Greenberg

- Stephanie Wilkins

- Andrew John Ford

- Edward John Whitney Allen

"Astor Asset Management 3 Ltd tiene la intención de reportar a todos estos solicitadores y barristers ante el comité regulador correspondiente para que investigue su posible conducta indebida. Los abogados mencionados están cometiendo perjurio al mentir reiteradamente ante el High Court del Reino Unido respecto a los términos del contrato de préstamo —y eso es perjurio."

Se espera pronto una resolución formal sobre si LK Law podrá continuar participando en el caso.

Fuentes:

- Astor Asset Management 3 Ltd: Ricardo Salinas acusado de contratar a Black Cube para influir en caso legal del Reino Unido por préstamo de 115 millones de USD

- Astor Asset Management 3 Ltd: Ricardo Salinas bajo escrutinio por presunto uso de Black Cube en disputa legal del Reino Unido

- https://www.lapoliticaonline.com/

mexico/politica- mx/loretta-ortiz- aseguro-que- salinas-pliego- intento-cooptarla- esas-son-las- formas-de-tentar/ - https://www.eluniversal.com.mx/

nacion/salinas- pliego-intento- comprarme-denuncia- loretta-ortiz- yo-no-acepto- casos-perdidos- responde-el- empresario/ - Documentos del High Court británico (Astor Asset Management 3 Ltd vs. Salinas)

- https://www.sinembargo.mx/

4615637/la-scjn- multara-a-la- empresa-de-salinas- pliego-por-obstaculizar- resolucion-fiscal/

Aviso legal: Los asuntos descritos implican acusaciones que permanecen bajo revisión legal y regulatoria. No existen aún determinaciones de responsabilidad o culpabilidad, y todas las personas y entidades mencionadas se presumen inocentes hasta que se demuestre lo contrario.

Perverting the Course of Justice: Ricardo Salinas Switches Lawyers Again Amid Espionage Allegations

Salinas originally retained Paul, Weiss, Rifkind, Wharton & Garrison LLP, later turning to Enyo Law of London. Most recently, he has been represented by LK Law of London, which appears to have lowered its standards in order to accept representing Ricardo Salinas Pliego. However, filings now before the UK High Court indicate that LK Law may face dismissal and sanctions after submitting transcripts and recordings suspected to have been obtained from confidential conversations between Salinas's legal adversaries while under alcohol inducement—part of a deceitful covert operation orchestrated by Black Cube, posing as legitimate clients at the instruction of Ricardo Salinas Pliego.

Legal observers are calling this one of the most serious cases of attempted perversion of justice in modern UK commercial litigation by solicitors and their barristers. If confirmed, it would mark the first instance of alcohol-compromised legal strategy being used as formal court evidence in a common law jurisdiction.

The ongoing Astor case is just one piece of a broader pattern. Salinas and his entities have been accused in Mexico of obstructing tax enforcement efforts, manipulating courts with frivolous appeals, and, according to Mexican Supreme Court justices, attempting to improperly influence rulings through intimidation and bribery. His companies have reportedly filed nearly 40 motions to delay fiscal rulings totalling over 34 billion pesos.

In the United States, Ricardo Salinas Pliego's companies are embroiled in a series of lawsuits, refusing to pay debts and facing accusations that include fraud, dissipation of assets, and breach of contract. Ricardo Salinas Pliego has been found to be in contempt of court, and a warrant for his arrest is pending before the U.S. court.

As the UK High Court weighs the implications of the Black Cube operation, questions mount over the role of Salinas's revolving door of law firms and how uncomfortable the lawyers are in continuing to represent him. Legal experts warn that continual lawyer-switching, when paired with unethical tactics, may signal a calculated effort to delay justice and undermine adversaries.

read full press release: https://www.prpocket.com/